Financial Inclusion

Recent Initiatives

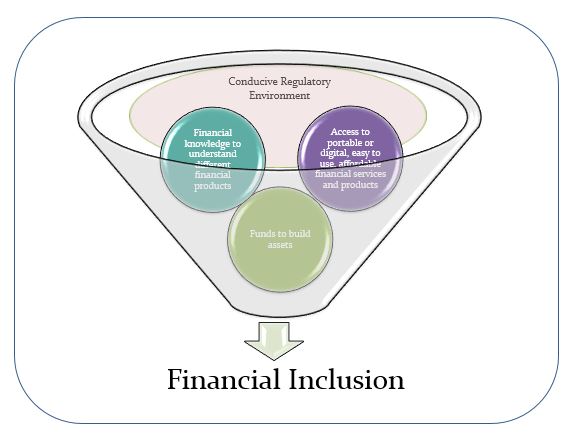

Financial inclusion is ensuring that everyone has access to affordable financial products and services that are delivered in a sustainable way. Access to a bank account is the first step to financial inclusion for many around the globe. A bank account allows individuals to save, pay for bills, send money, and receive payments. Owning an account also provides access to other financial services such as credit, insurance, start-up capital, and, it provides a mechanism for people to manage risk, pay for education, health care, and improve wellbeing.

The World Bank Global Findex report, indicates that 2 billion adults do not have an account and more than a million formal and informal businesses lack adequate financing to thrive. In this report, women and the rural poor are identified as the most hard-to-reach populations and the most financially excluded and affected groups. Additional reports also include youth as a financially excluded group.

Globally, particularly in resource-limited settings, the hard-to-reach populations have proved to be the biggest challenge when it comes to improving financial inclusion. This is because the traditional “brick and mortar” mechanism of delivering financial services is not optimal for these populations. Digital financial technology has emerged as a promising answer to expand access to financial services for these hard-to-reach groups. Digital financial technology provides an opportunity for financial service providers to design financial products that better fit the needs of unbanked, hard-to-reach individuals including youth, women, and the rural poor.

At GSDI, our work focuses on facilitating financial inclusion for hard-to-reach populations. We believe that financial inclusion is a foundation for economic security. We increase financial capability for hard-to-reach populations by ensuring access and services to affordable, easy to use financial products; improving financial knowledge of these populations so that they can understand the different financial services, and improving their money management skills through financial education.

At GSDI, our work focuses on facilitating financial inclusion for hard-to-reach populations. We believe that financial inclusion is a foundation for economic security. We increase financial capability for hard-to-reach populations by ensuring access and services to affordable, easy to use financial products; improving financial knowledge of these populations so that they can understand the different financial services, and improving their money management skills through financial education.

GSDI partners with financial service providers to provide digital financial services to hard-to-reach populations to ensure that being remotely located or the prohibitive fees and costs for traditional financial services is not a barrier to those who are currently financially excluded.